79% of the portfolio has time to maturities more than 20 years. In other words, a leveraged fund exhibits more volatility than would an unleveraged fund investing in the same securities.

Cutting the dividend will cause investors to dump shares, leading to a.

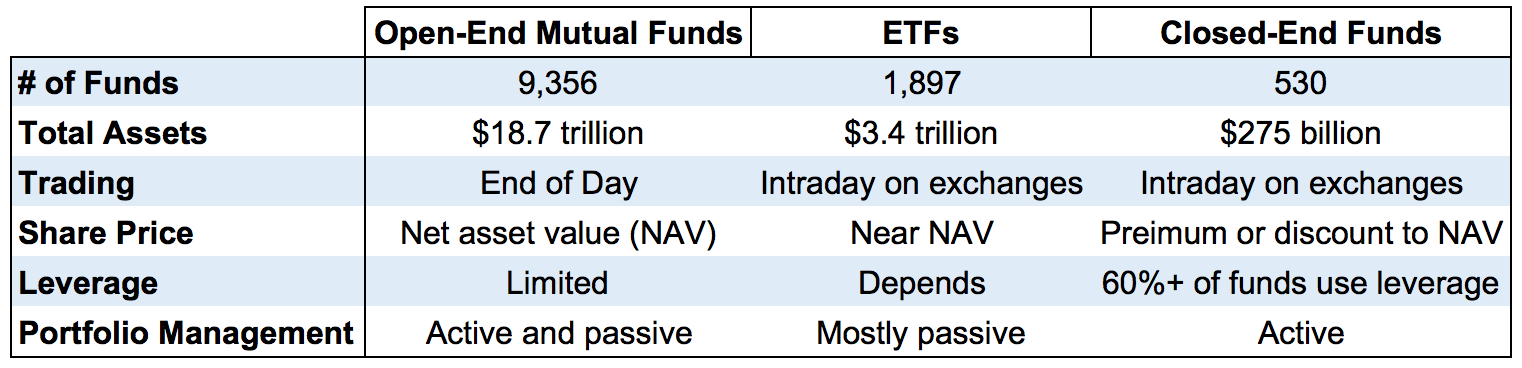

Closed end funds leverage risk. The use of leverage is subject to risks, including the potential for higher net asset value (“nav”) and market price volatility and This is not the portfolio to own if long term rates start to increase. Cefs are complex investments that can, because of leverage, have hidden risks not obvious to a typical investor.

The table below shows how the effect works on the upside and downside. Leverage magnifies returns, both positively and negatively. However, investors should be aware of the rationale and risks behind leverage.

While they can provide the opportunity for. If interest rate costs get too high, the fund will be forced to cut the dividend. On the following pages we provide an overview of how leverage works, strategies used to create leverage and their inherent costs, as well as the potential benefits and risks that leverage entails.

Leverage could potentially amplify both the fund’s net asset value (nav) and its distribution; Nuveen preferred income opportunities fund (nyse: In additional to the long maturities, the prf portfolio is 34% leveraged.

Leverage can lead to larger losses during market downturns.

0 komentar:

Posting Komentar