Triggering terms that require *s. • rv loans up to 108 months;

Sometimes mortgage advertisers are not fully aware of the regulation z “triggering terms” rules that require additional disclosures to be made in your mortgage ad.

Closed end loan trigger terms. The periodic rate used to compute the finance charge or the annual percentage rate; • 10, 20, or 30 year mortgages; (1) the amount or percentage of any downpayment;

• “no fees” • “no transaction charges” • not: The disclosures will be in a form that the ♦“up to 48 months to pay” ♦“90 percent financing” ♦“as low as $50 a month” ♦“36 equal payments” ♦$500 total.

Number of payments or repayment period. The amount of the down payment, expressed either as a percentage or as a dollar amount. For instance, a few terms for closed end credit that trigger the need for additional disclosure are:

Making loans based predominantly on the foreclosure or liquidation value of a borrower's collateral rather than on the borrower's ability to repay the mortgage according to its terms Engaging in fraud or deception to conceal the true nature of the mortgage loan obligation, or ancillary products, from an unsuspecting or unsophisticated borrower b. The disclosures will be in a reasonably understandable form and legible.

30 yr mtg loans or 60 low monthly payments *special disclosures. (4) the amount of any finance charge. (d) advertisement of terms that require additional disclosures—(1) triggering terms.

Amount or percentage of any down payment Clearly and conspicuously in writing. A list of different annual percentage rates applicable to different balances, for example, does not trigger further disclosures under § 1026.24 (d) (2) and so is.

Øminimum, fixed, transaction, activity or similar charge øapr øif plan is variable rate, this fact must be disclosed ødiscounted variable rate ømembership or participation fee Here’s a quick review of the triggering terms that come straight from reg z 1026.24: (3) the amount of any payment;

Stating “no downpayment” does not trigger additional disclosures. (2) the number of payments or period of repayment; If any of the following terms is set forth in an advertisement, the advertisement must include the additional disclosures described in d.2.

There are triggering terms associated with different loan products, such as home equity credit lines, closed end credit, helocs, and many other loan products. The rule applies only if the advertisement contains one or more of the triggering terms from § 1026.24 (d) (1). In a form the member may keep.

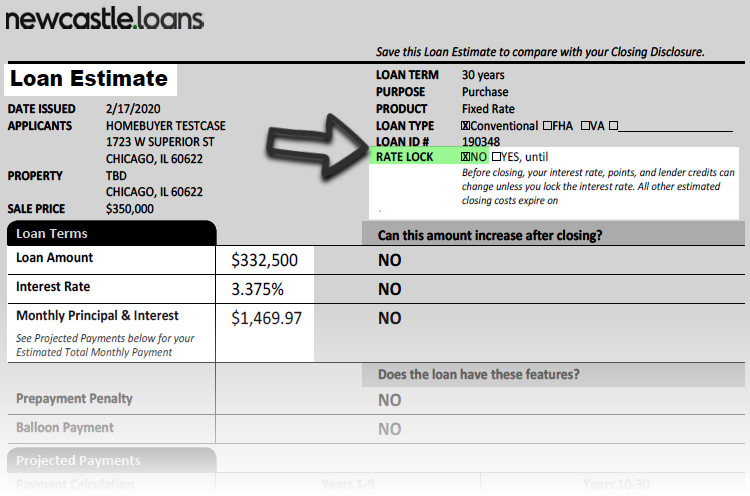

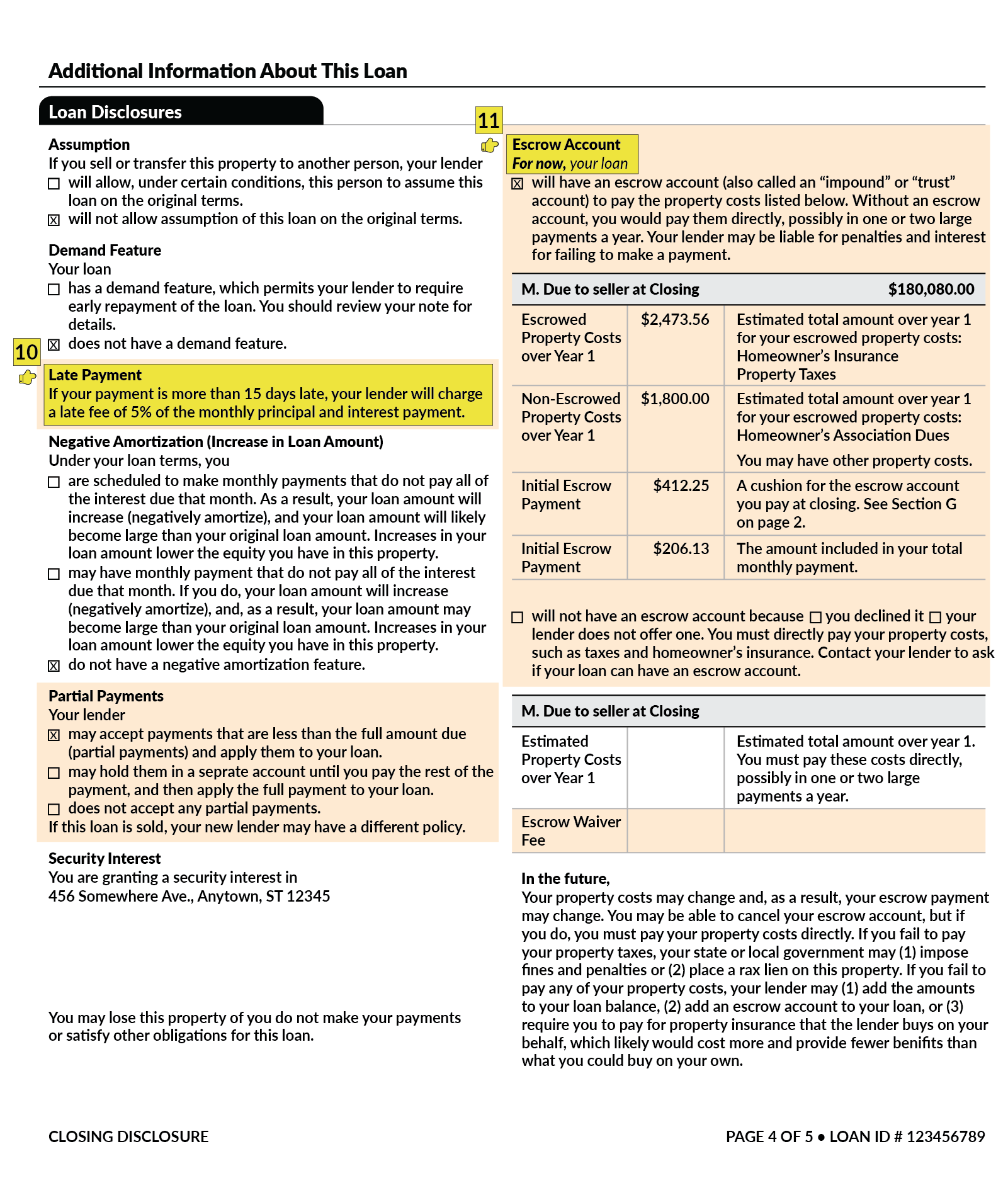

• 36 to 72 month auto loans; These disclosures must be used for mortgage loans for which the creditor or mortgage broker receives an application on or after august 1, 2015. The loan estimate is provided within three business days from application, and the closing disclosure is provided to consumers three business days before loan consummation.

0 komentar:

Posting Komentar